September 6, 2023

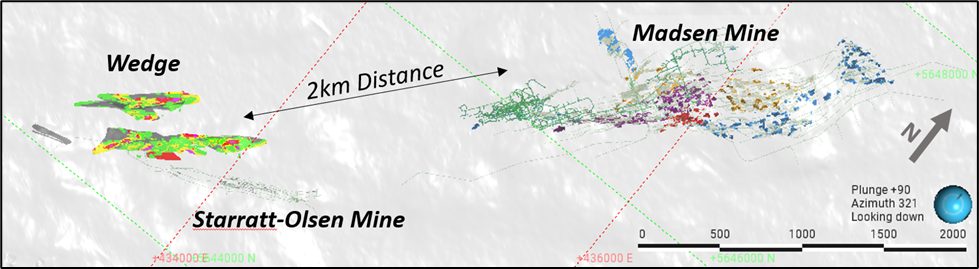

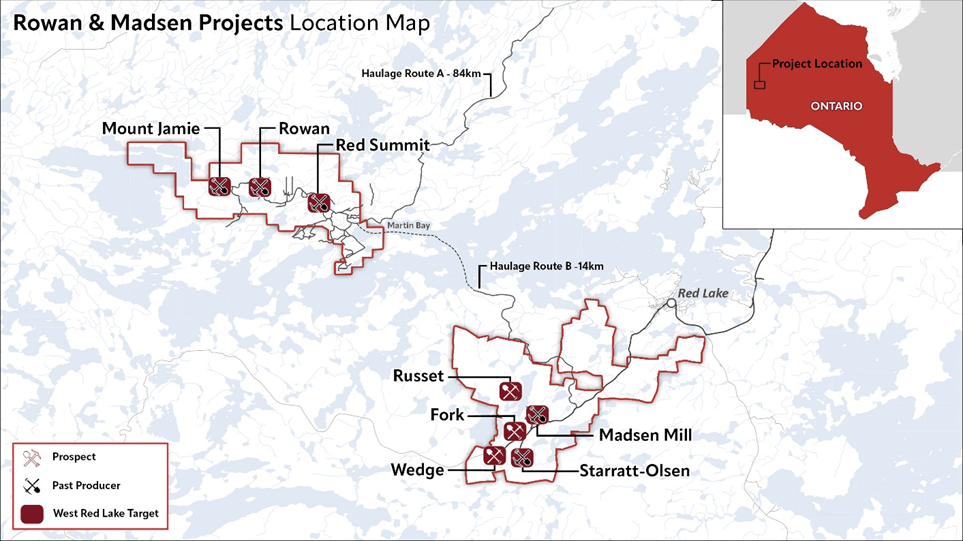

West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV:WRLG) (OTCQB: WRLGF) is pleased to announce the commencement of surface drilling at the Wedge target, located approximately 2 kilometres (“km”) southwest from its 100% owned Madsen Mine in the prolific Red Lake Gold District of Northwestern Ontario, Canada. The drilling program will consist of up to 3,000 metres (“m”) with the goal of growing and upgrading the existing mineral resources at Wedge, which currently contain an Indicated mineral resource of 56,100 ounces (“oz”) grading 5.6 grams per tonne (“g/t”) gold (“Au”), with an additional Inferred resource of 78,700 oz grading 5.7 g/t Au[1].

HIGHLIGHTS:

- Surface exploration drilling to commence at the Wedge target – located 2 km southwest from the Madsen Mine

- Drilling will be focused on extending high-grade zones at Wedge and increasing confidence in the overall mineral resource

- Wedge currently hosts an Indicated resource of 56,100 oz of gold grading 5.6 g/t Au1 and an Inferred resource of 78,700 oz of gold grading 5.7 g/t Au1

- The Wedge resource sits adjacent to the past-producing Starratt-Olsen Mine which historically processed 823,554 tonnes grading 6.16 g/t Au for approximately 163,000 oz of gold[2]

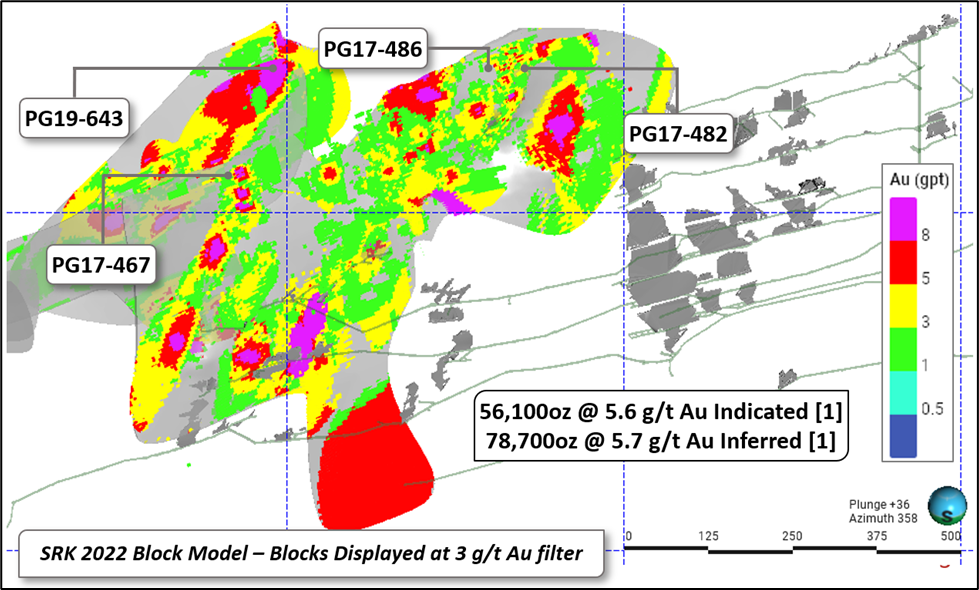

- Previous drilling highlights from the Wedge target include:

- Hole PG17-486 Intersected 10.33 m @ 24.94 g/t Au, from 16.67 m to 27 m

- Hole PG17-467 Intersected 16.6 m @ 17.49 g/t Au, from 11.45 m to 28 m

- Hole PG17-482 Intersected 14.4 m @ 8.35 g/t Au, from 28 m to 42.4 m

- Hole PG19-643 Intersected 1 m @ 108.5 g/t Au, from 103 m to 104 m

Shane Williams, President & CEO, stated, “Our team is very excited to be back drilling near the Madsen Mine asset. We view Wedge as a key component in our overall vision of staying committed to exploration and unlocking the full potential of all our high-grade assets in the Red Lake Mining District. With Wedge being located just 2 km away from the existing mill facilities at Madsen, on fully patented claims and directly adjacent to the past-producing Starratt-Olsen mine, we can see a clear path forward for permitting at Wedge and view it as a high-caliber candidate for a future mill-feed source at Madsen.”

FIGURE 1. Plan view map showing location of Wedge deposit relative to the Madsen Mine.

FIGURE 2. Oblique view of Wedge resource showing 2022 SRK Block Model and location of previous drilling highlights noted in this press release.1

DISCUSSION

The Wedge deposit comprises four resource zones (DV, CK, MJ and OL) and one mineralized zone (86) that remains at the exploration target stage. All five zones generally correspond with historical surface showings and mineralized areas (Branson, 2019a).

The DV and CK Zones lie within the same structure that hosts the Fork Main Zone, but about 900 m along strike to the southwest. The intervening area is prospective for potential resource expansion and this area includes the 86 Zone exploration target. The 86 Zone was explored in 1998 by mechanical stripping and recent mapping of these outcrops (Cooley and Leatherman, 2015) suggests that 86 Zone may represent the southern extension of the Fork deposit as the host rocks are continuous and the style of mineralization is similar. At 86 Zone, rock sampling by previous workers of outcropping iron formation characterized by banded magnetite, pyrrhotite and amphibole has returned highly anomalous gold values. Drilling directly underneath this surface mineralization in 2017 returned multiple intercepts exceeding 5 g/t Au (up to 22.9 g/t Au over 1.1 m). Gold is hosted in quartz veins spatially associated with both iron formation and altered basalt.

In detail, the DV and CK Zones comprise a series of up to three concordant resource shapes across a collective width of 70 m and a maximum strike length of 700 m. At the DV Zone, gold is hosted within discontinuous quartz ± chlorite-amphibole veins (VBGQ veins) with biotite-amphibole-diopside selvedges and minor pyrite, pyrrhotite, chalcopyrite and arsenopyrite (Branson, 2019b). These veins are hosted in weakly altered mafic volcanic rocks or more commonly within moderately to strongly altered mafic volcanic rock (BSLA or SAFZ). At the CK Zone, the geology and mineralization are comparable to the DV Zone, though the host basalt rocks have been cut by quartz porphyry. A key relationship is that the veins and the enveloping alteration zones are transected by and transposed into the main S2 foliation of the host rocks – an identical relationship to the Madsen deposit.

The OL Zone exploration target lies about 450 m southwest along strike from the edge of the CK Zone resource shape in an area characterized by deformed gold-bearing quartz veins hosted in zones of deformed quartz porphyry (QZPY) and strongly altered foliated zones (SAFZ). Outcrop stripping, surface rock sampling and diamond drilling by previous workers have delineated two parallel trends of alteration and veining separated by approximately 25 m and extending for a strike length of 200 m. The zone is open both along strike and at depth.

The MJ Zone is hosted by two concordant shear zones up to 40 m in width characterized by deformed gold-bearing quartz veins hosted within altered and deformed basalt and peridotite within the Russet Lake Ultramafic. Current drilling has delineated these shear zones over 500 m of strike length and to 320 m depth with the structure remaining open along strike and down-dip.

In addition to being a part of the recognized property-wide structural architecture associated with gold mineralization responsible for mineralization at Madsen, Fork and Russet, the Wedge deposit exhibits similar high-level characteristics to the Madsen deposit (same alteration and structural timing), however gold tends to be more often hosted in discrete quartz veins rather than disseminated within intervals of pervasively silicified rock, as is more common in the Madsen deposit.

The apparent plunge of mineralization along these structures – best demonstrated at the well-tested DV Zone – appears to be associated with the intersection of the structures and major rheological and geochemical contrasts between relatively rigid and massive basalt and adjoining IRFM and ultramafic units (Branson, 2019b). This architecture is comparable to the plunge at the Austin and South Austin zones in the Madsen deposit which are defined by intersection of the mineralized zones and mafic/ultramafic contacts.

MARKETING AGREEMENT

The Company has entered into an agreement with OGIB Corporate Bulletin Ltd. (“OGIB”) dated August 23, 2023 (the “OGIB Agreement”), whereby OGIB has agreed to provide marketing services to the Company, including the publication of a series of online articles about the Company. The term of the OGIB Agreement is 6 months, commencing on September 1, 2023.

The Company paid OGIB a cash fee of CAD $125,000 upon entry into the OGIB Agreement.

OGIB is a subscription service based out of Victoria, British Columbia which provides research on public companies and is wholly-owned by Keith Schaefer. OGIB and Keith Schaefer are arm’s length from the Company and hold directly, or indirectly 171,429 common shares of the Company.

QUALITY ASSURANCE/QUALITY CONTROL

West Red Lake Gold’s Wedge target presently hosts a National Instrument 43-101 (“NI 43-101”) Indicated Mineral Resource of 56,100 oz grading 5.6 g/t Au and an Inferred Mineral Resource of 78,700 oz grading 5.7 g/t Au. Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. A full copy of the SRK report is available on the Company’s website and on SEDAR.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Amandip Singh, VP Corporate Development

Tel: 416-203-9181

Email: investors@westredlakegold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute “forward-looking statements”. When used in this document, the words “anticipated”, “expect”, “estimated”, “forecast”, “planned”, and similar expressions are intended to identify forward-looking statements or information. These statements are based on current expectations of management, however, they are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking statements in this news release. Readers are cautioned not to place undue reliance on these statements. West Red Lake Gold Mines Ltd. does not undertake any obligation to revise or update any forward- looking statements as a result of new information, future events or otherwise after the date hereof, except as required by securities laws.

[1] Mineral resources are estimated at a cut-off grade of 3.38 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Independent NI 43-101 Technical Report and Updated Mineral Resource Estimate for the PureGold Mine, Canada”, prepared by SRK Consulting (Canada) Inc. and dated June 16, 2023. A full copy of the SRK report is available on the Company’s website and on SEDAR.

[2] http://www.geologyontario.mndm.gov.on.ca/mndmfiles/mdi/data/records/MDI52K13NW00011.html