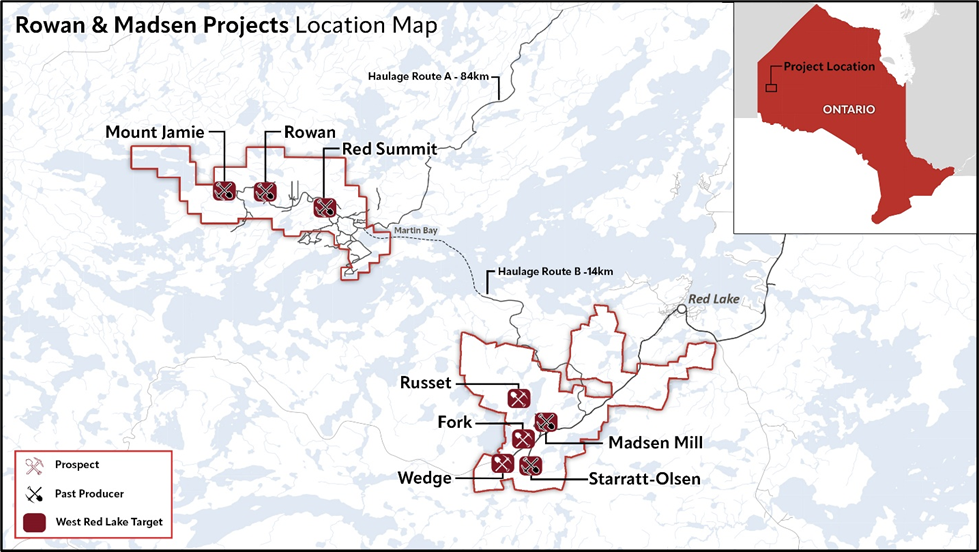

West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) announces an updated Mineral Resource Estimate (“MRE”) effective as of March 1, 2024, on its 100% owned Rowan Mine Deposit, located in the Red Lake Gold District of Northwestern Ontario, Canada.

- Indicated resources of 476,323 tonnes grading 12.78 grams per tonne (“g/t“) gold (“Au“), for a total of 195,746 ounces (“oz“) Au.

- Inferred resources of 410,794 tonnes grading 8.76 g/t Au, for a total of 115,719 oz Au.

KEY TAKEAWAYS:

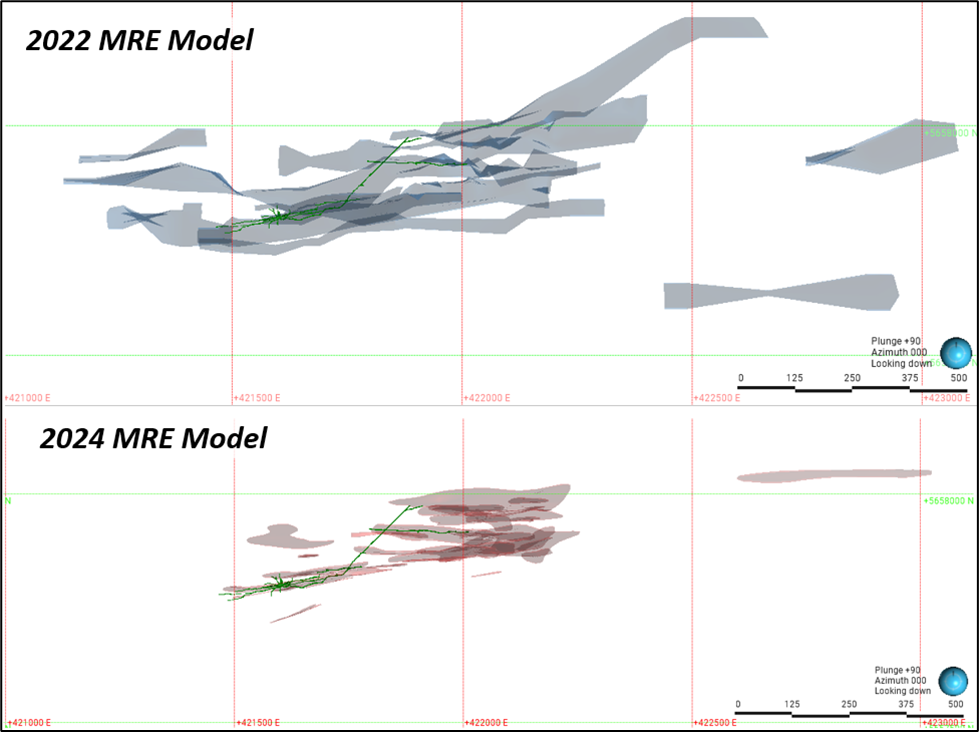

- Relative to the 2022 Rowan MRE, there was a decrease in the Inferred mineral resources from approximately 827,000 ounces to 116,000 ounces and an increase in Indicated mineral resources from zero to approximately 196,000 ounces. The drop in Inferred metal content is mainly attributed to 1) conversion of Inferred to Indicated resources, 2) a more rigorous modeling approach, and 3) more stringent resource estimation parameters implemented to account for the high gold grades typically seen at Rowan.

- The integration of oriented drilling data and top-to-bottom geochemical analysis allowed the team to reconstruct the geologic interpretation at Rowan resulting in a much more tightly constrained, higher-grade resource that should lend itself more effectively to any future reserve calculation and underground mining design (Figure 1).

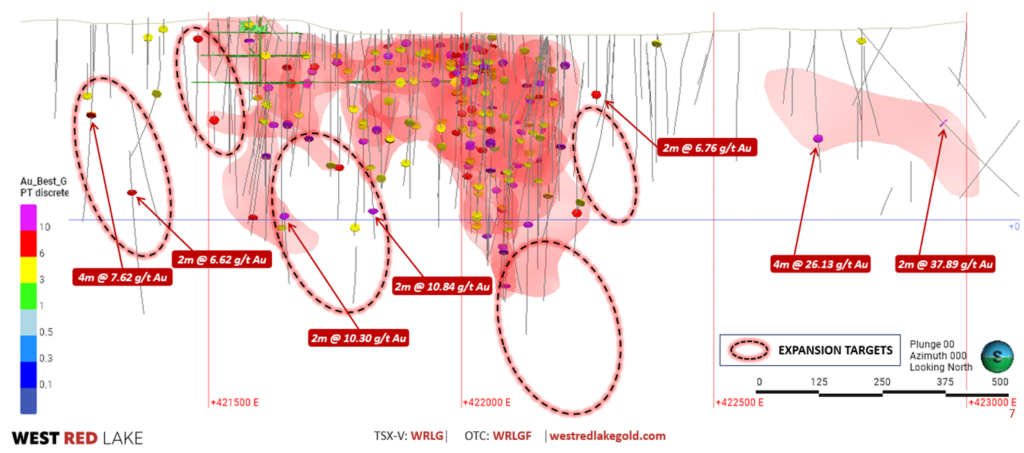

- A $4.5M drill program is planned and fully funded for up to 15,000m of drilling at Rowan in 2024, focused on growth and resource expansion on the main Rowan Mine deposit (Figure 3).

Shane Williams, President & CEO, stated, “The 2024 Rowan MRE model represents a complete reinterpretation of the structural controls on mineralization and reflects a more conservative estimation approach in-line with industry best practices. When drilling off structurally complex high-grade gold systems that contain significant amounts of coarse gold it is essential to have a solid understanding of the geology and controls on mineralization early in the process. We are very encouraged to see a significant portion of higher confidence Indicated resources come from this MRE update – and at grades 40% higher than the 2022 MRE. The objective for this year at Rowan will be growth, and we continue to see significant potential for expanding this deposit at depth and along strike.”

ROWAN 2024 MINERAL RESOURCE ESTIMATE:

- The 2024 MRE update for Rowan incorporated an additional 62 holes for 20,211.4m of oriented NQ diamond drill core since the December 2022 MRE.

- A total of twenty-six (26) mineral domains were created to constrain the mineralization.

- For more detailed information on the Rowan 2024 MRE model please refer to the Technical Report entitled “Updated Mineral Resource Estimate for the Rowan Property, Ontario, Canada” dated April 26, 2024 and filed contemporaneously with this press release on April 26, 2024, prepared for WRLG by Sims Resources, LLC (the “Technical Report”), copies of which can be found on SEDAR+ at www.sedarplus.ca.

TABLE 1. Summary of the Rowan 2024 Mineral Resources as of April 26, 2024

| Mineral Resource Statement – Rowan Mine Deposit | |||

| Classification | Tonnes (t) | Gold Grade (g/t) | Gold Troy Ounces (oz Au) |

| Indicated | 476,323 | 12.87 | 195,746 |

| Inferred | 410,794 | 8.76 | 115,719 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources were estimated at a gold cut-off grade of 3.80 g/t using a long-term gold price of $1,800 USD per ounce.

- Density used for the estimation on all domains was set at 2.8 g/cm3.

- There are no Mineral Reserves currently estimated at the Rowan Project.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- Mineral Resources are reported within vein wireframes at the stated cut-off grade of 3.80 g/t Au.

- The effective date of the Mineral Resources is March 1, 2024.

FIGURE 1. Plan view image comparing the 2022 MRE domains to 2024 MRE domains.

DISCUSSION

The Rowan Vein System has been the focus of most of the exploration on the Property since the initial discovery of four sub-parallel narrow veins on surface at “Discovery Hill”. Since then, these veins have been drifted upon from underground on three levels and extensively drilled, including 62 drill holes for 20,211.4m in 2023. The drilling completed at the Rowan Mine deposit in 2023 focused on validating historical data across the Inferred Resource, and also infilling apparent gaps in the analytical data set which was a product of very selective sampling techniques implemented during previous drilling campaigns.

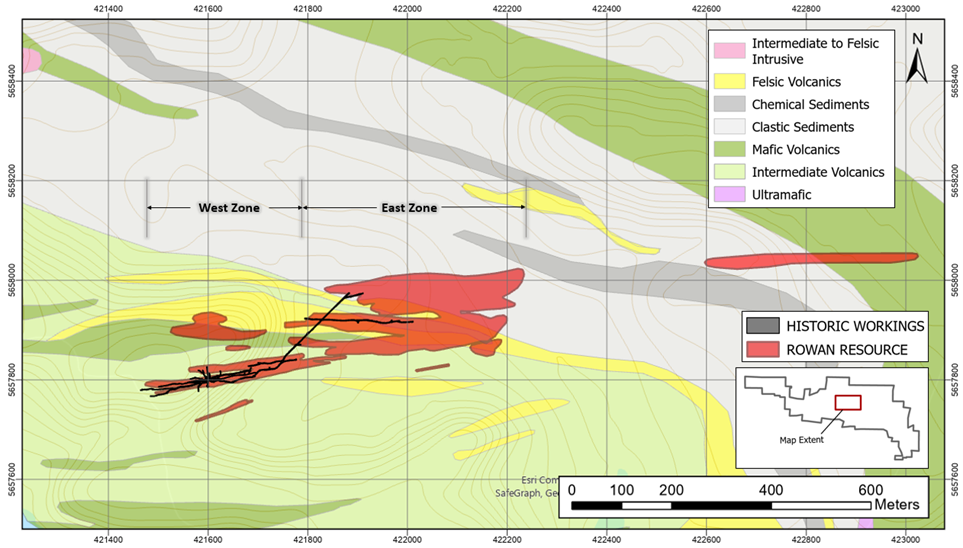

The overall deposit consists of numerous, narrow, high-grade quartz veins that define an east-northeast trending corridor, approximately 150 m wide. This corridor mainly transects the lower mafic to intermediate metavolcanic units of the Ball assemblage in the hinge of the property scale antiform and appears to dissipate once it intersects the unconformity with the metasedimentary Slate Bay assemblage to the east (Figure 2).

The best gold grades often occur when coarse and visible native gold is present. This occurs within distinct 10 cm to 30 cm up to a metre of bluish to grey, glassy quartz veins/stringer zones. Rarely do these individual veins exceed 60 cm wide with alteration halos tending to be localized. Broad zones of diffuse silicification have generally not been found. Trace to 1% pyrite and pyrrhotite is common within these veins/stringers. Less common but a better positive indicator of gold grade is the occurrence of sphalerite, galena, arsenopyrite, and chalcopyrite. Generally total sulphides make up less than 2%. Metallurgical tests indicate favourable recovery characteristics.

The previous interpretation of the Rowan Vein System (Kita, 2022) was that the veins were emplaced after D2 and were essentially undeformed and highly continuous over hundreds of meters. Such an interpretation was supported by the consistency of multiple narrow vein occurrences in drillholes spanning long strike lengths. With the benefit of a tighter drill spacing and oriented core following the 2023 WRLG drill campaigns, this interpretation is no longer tenable. Strictly planar vein continuity could no longer be demonstrated since east-west trending veins appeared to line up along east-northeast trends. Such an arrangement requires long trains of minor folds, and transposition into the dominant fabric. This is further supported by: (i) strongly recrystallized textures in the quartz veins, (ii) dominant parallelism with the strong penetrative S2 foliation, (iii) the great-circle distribution of poles to foliation as measured in oriented core, and (iv) locally observed minor folds, showing that the veins are overprinted by the strong ductile D2 deformation.

Modelling such complex geological shapes as transposed veins systems can be achieved using implicit methods in Leapfrog provided enough closely spaced data are present to capture the variability of the deformed vein geometries. This method is being used successfully at the Madsen mine where drill spacing is predominantly six meters or less. At Rowan, the drill spacing is not nearly as tight, but still tight enough to produce geologically plausible representations of the transposed vein geometries. Unfortunately, due to the wider drill spacing in some areas, the implicit shapes could not be adequately controlled for unsupported ‘blowouts’, which could lead to unreasonably inflated tonnage estimates. For this reason, and to minimize dilution in the model, the implicit shapes were used only as a guide for manually constructed vein models, using the vein modelling tool in Leapfrog. This approach allowed the construction of more tightly controlled shapes that capture the structural style of the vein system yet remain optimized for use in resource estimation.

The result is a much more realistic model of the vein system that agrees with the structural observations at the deposit and core scales, and that aligns with the structural setting and controls seen at other deposits within the belt, such as at the Madsen and Red Lake mines.

FIGURE 2. Plan view of Rowan deposit projected to surface, with a transparent geology overlay.

FIGURE 3. Rowan Deposit longitudinal section showing high-priority expansion target areas for 2024 drill program[[1]]. Drill intercepts shown in this figure have been composited to 2m intervals.

QUALITY ASSURANCE/QUALITY CONTROL

Drilling completed at the Rowan Property consists of oriented NQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at WRLG’s Mt. Jamie core processing facility. Minimum allowable sample length is 0.5m. Maximum allowable sample length is 1.5m. Standard reference materials and blanks are inserted at a targeted 5% insertion rate. The drill core is then cut lengthwise utilizing a diamond blade core saw along a line pre-selected by the geologist. To reduce sampling bias, the same side of drill core is sampled consistently utilizing the orientation line as reference. For those samples containing visible gold (“VG”), a trained geologist supervises the cutting/bagging of those samples, and ensures the core saw blade is ‘cleaned’ with a dressing stone following the VG sample interval. Bagged samples are then sealed with zip ties and transported by WRLG personnel directly to SGS Natural Resource’s Facility in Red Lake, Ontario for assay.

Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm. A riffle splitter is then utilized to produce a 500g course reject for archive. The remainder of the sample is then pulverized to 85% passing 75 microns from which 50g is analyzed by fire assay and an atomic absorption spectroscopy (AAS) finish. Samples returning gold values > 10 g/t Au are reanalyzed by fire assay with a gravimetric finish on a 50g sample. Samples with visible gold are also analyzed via metallic screen analysis (SGS code: GO_FAS50M). For multi-element analysis, samples are sent to SGS’s facility in Burnaby, British Columbia and analyzed via four-acid digest with an atomic emission spectroscopy (ICP-AES) finish for 33-element analysis on 0.25g sample pulps (SGS code: GE_ICP40Q12). SGS Natural Resources analytical laboratories operates under a Quality Management System that complies with ISO/IEC 17025.

West Red Lake Gold’s Rowan Property presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated Mineral Resource of 473,974 t at an average grade of 12.87 g/t Au containing 196,120 ounces of gold, and an Inferred Mineral Resource of 379,571 t at and average grade of 8.49 g/t Au, with a cut-off grade of 3.8 g/t Au (as set out in the Technical Report).. The Indicated and Inferred Mineral Resources are located in the area of the historic underground Rowan Mine site and situated within a 1.8 km strike length portion of the regional scale Pipestone Bay St Paul Deformation Zone.

For a better understanding of the Rowan deposit, readers are encouraged to read the Technical Report and other public disclosure of the Company, including all qualifications, assumptions, exclusions and risks that relate to the Mineral Resource and Mineral Reserve estimates. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101. Mr. Robinson is not independent of West Red Lake Gold.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Freddie Leigh

Tel: (604) 609-6132

Email: investors@westredlakegold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as “anticipate”, “expect”, “estimate”, “forecast”, “planned”, and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to the potential of the Madsen Mine and Rowan Mine; any untapped growth potential in the Madsen deposit or Rowan deposit; the Company’s intention to establish additional drilling platforms; and the Company’s future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward‐looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company’s securities; fluctuations in commodity prices and changes in the Company’s business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company’s management’s discussion and analysis for the year ended November 30, 2023, and the Company’s annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management’s current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

[1] Mineral Resources are estimated at a cut-off grade of 3.8 g/t Au and using a gold price of US$1,800/oz. Please refer to the technical report entitled “Updated Mineral Resource Estimate for the Rowan Property, Ontario, Canada” dated April 26, 2024 prepared for WRLG by Sims Resources, LLC.