West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp. and Eight Capital to act as co-lead agents on behalf of a syndicate of agents (collectively, the “Agents”) in connection with a “best efforts” private placement of 19,235,000 units of the Company (each, a “Unit”) at a price of C$0.52 per Unit (the “Offering Price”) for gross proceeds of C$10,002,200 (the “Offering”).

Each Unit will consist of one common share of the Company (each, a “Unit Share”) and one common share purchase warrant of the Company (each a “Warrant”). Each Warrant will entitle the holder to acquire one common share of the Company for 36 months from the closing of the Offering at a price of C$0.68.

The Agents will have an option (the “Agents’ Option”) to increase the size of the Offering by up to C$1,508,000 through the sale of an additional 2,900,000 Units at the Offering Price, which Agents’ Option is exercisable, in whole or in part, at any time up to 48 hours prior to the Closing Date (defined herein).

The net proceeds received from the Offering will be used to advance the Company’s mineral properties in Ontario, as well as for working capital and general corporate purposes.

It is anticipated that closing of the Offering will occur on or about November 28, 2023 (the “Closing Date”), or such other date or dates as the Company and the Underwriters may agree. The Offering is subject to the satisfaction of certain conditions, including receipt of all applicable regulatory approvals including the approval of the TSX Venture Exchange. The securities sold under the Offering will have a hold period in Canada of four months and one day from the closing date in accordance with applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful, including any of the securities in the United States of America. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any state securities laws and may not be offered or sold within the United States or to, or for account or benefit of, U.S. Persons (as defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

ABOUT WEST RED LAKE GOLD MINES

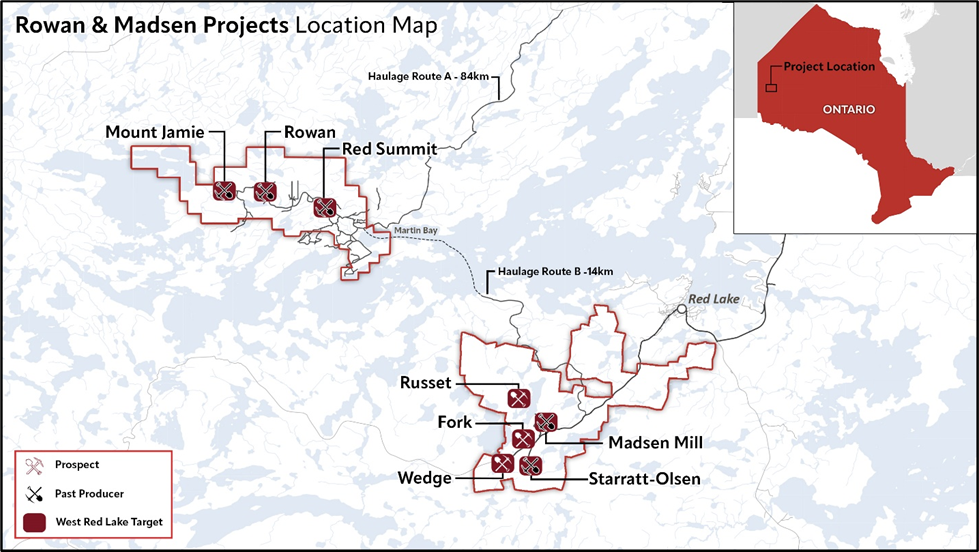

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world’s richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Amandip Singh, VP Corporate Development

Tel: 416-203-9181

Email: investors@westredlakegold.com or visit the Company’s website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute “forward-looking statements”. These forward-looking statements include statements in respect closing of the Offering and use of proceeds of the Offering. When used in this document, the words “anticipated”, “expect”, “estimated”, “forecast”, “planned”, and similar expressions are intended to identify forward-looking statements or information. These statements are based on current expectations of management, however, they are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking statements in this news release. Readers are cautioned not to place undue reliance on these statements. West Red Lake Gold Mines Ltd. does not undertake any obligation to revise or update any forward- looking statements as a result of new information, future events or otherwise after the date hereof, except as required by securities laws. The Company seeks safe harbour.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available at www.sedarplus.ca.